FAQs

common questions and concerns about PayEDge and its services

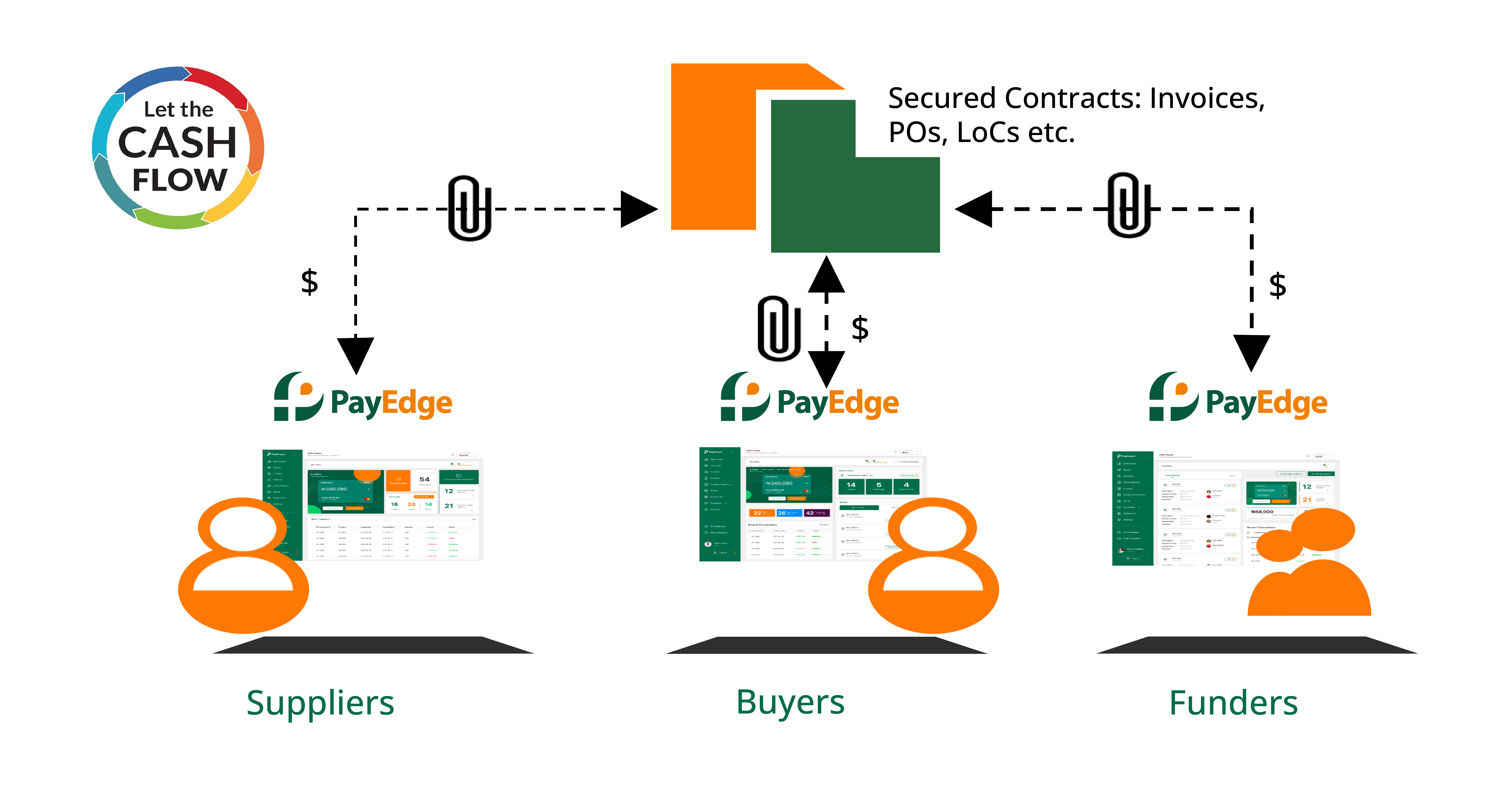

PayEdge is a digital platform that connects businesses for faster payments, stronger relationships, and efficient growth in supply chain finance.

PayEdge benefits three main stakeholder groups:

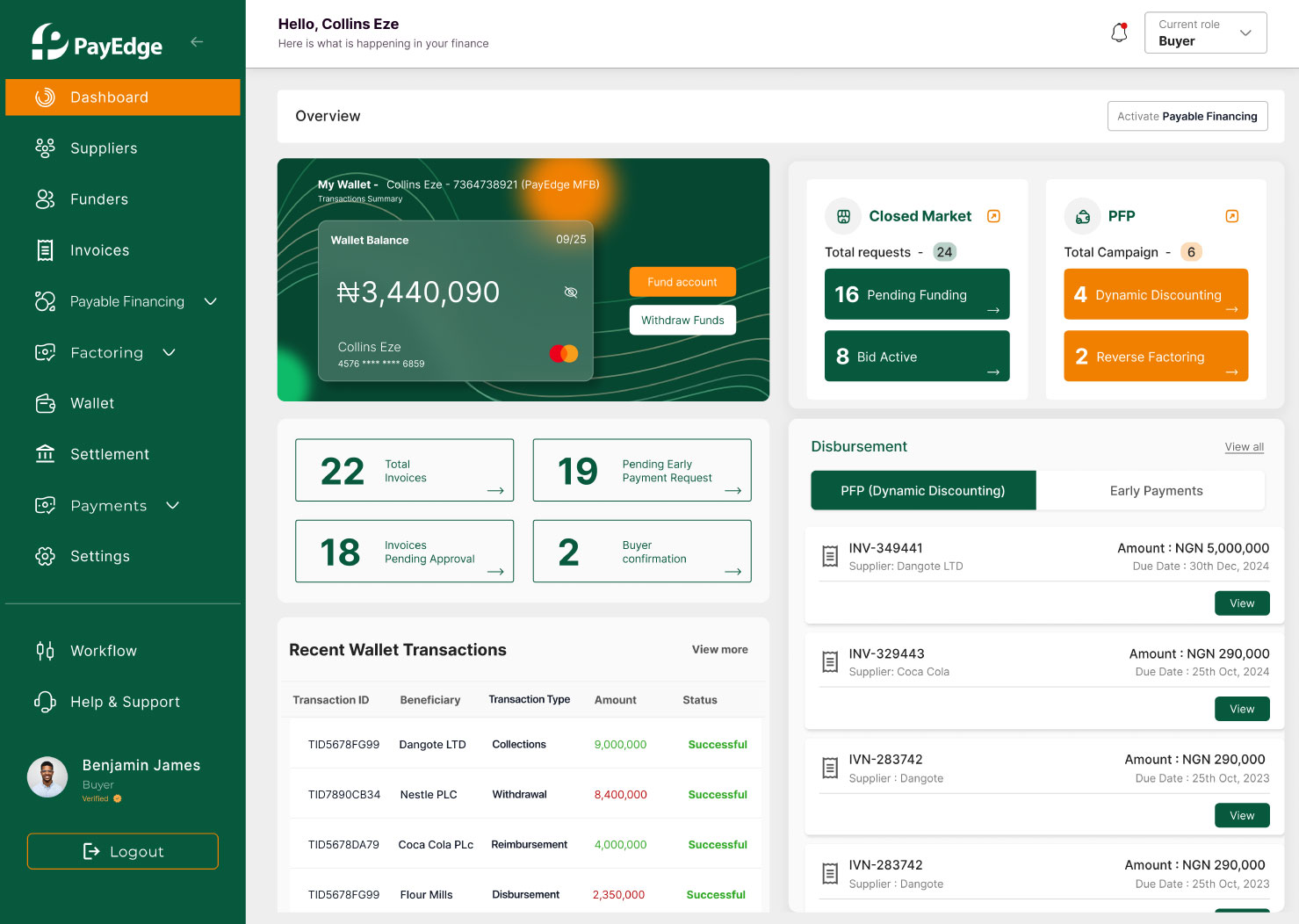

Buyers: Businesses seeking to optimise cash flow, improve supplier relationships, and streamline operations.

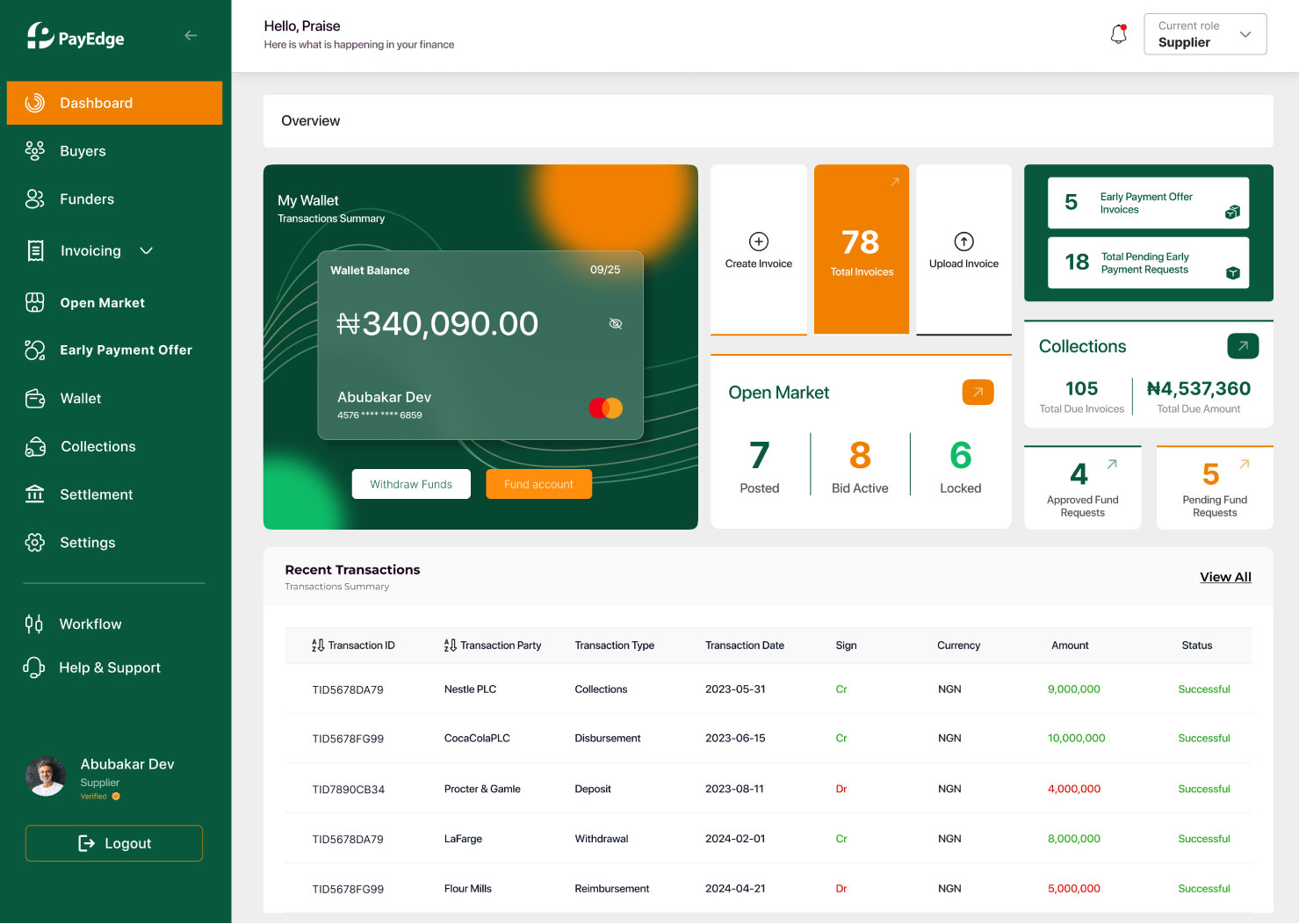

Suppliers: Businesses looking to get paid faster, reduce trade receivables, and build stronger buyer relationships.

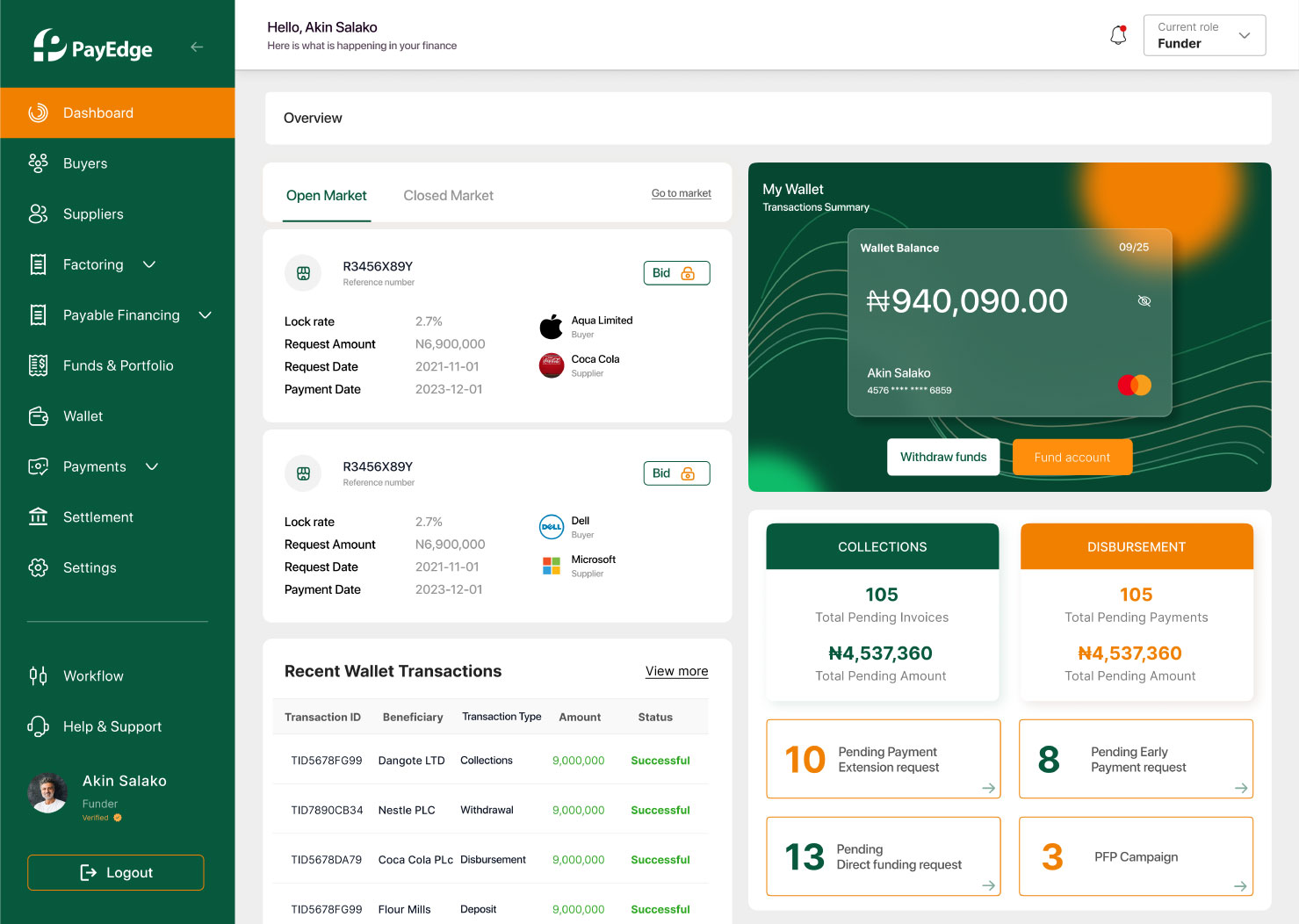

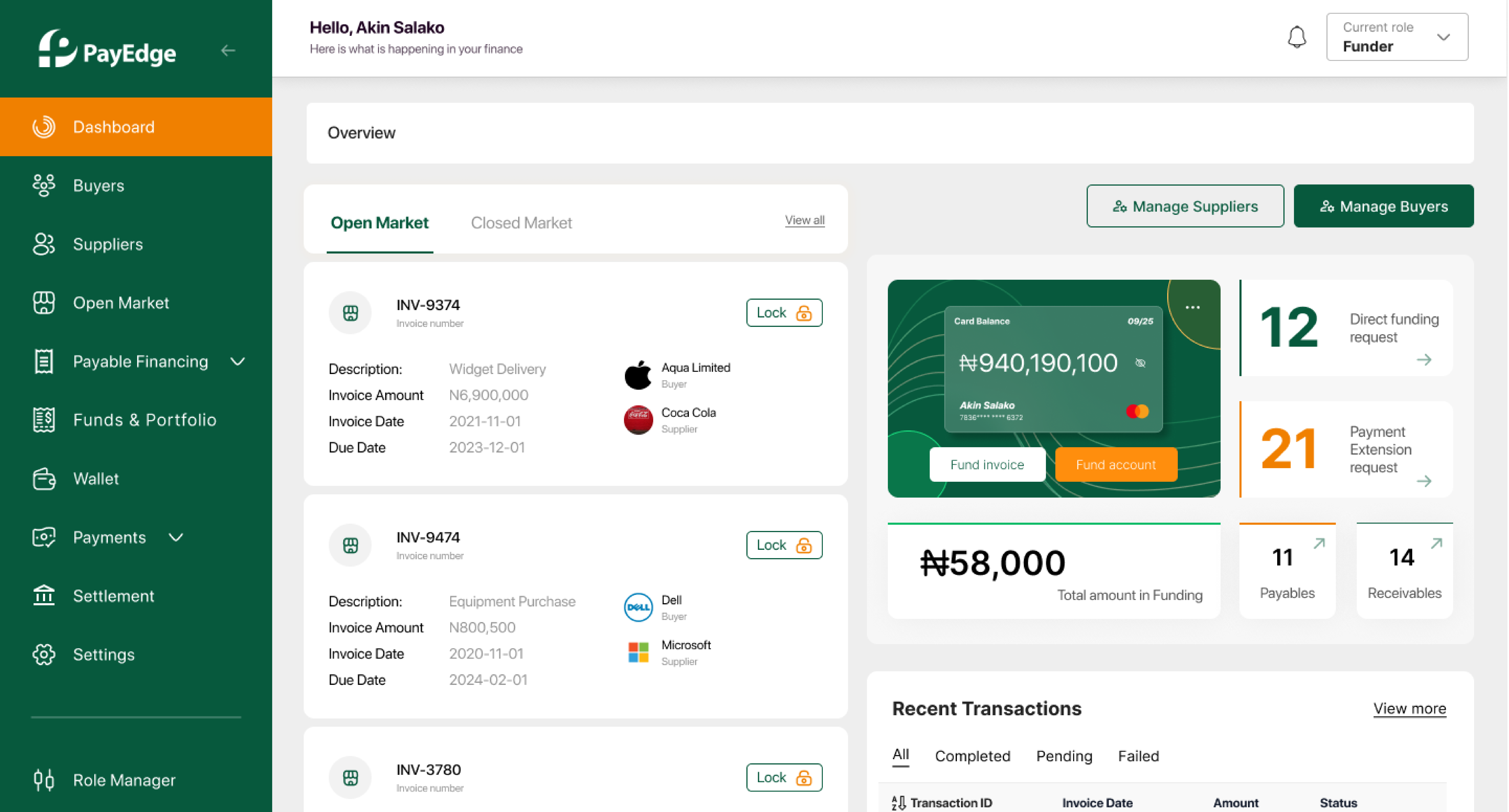

Funders & Investors: Funders and Investors seeking profitable returns portfolio diversification through pre-vetted financing options.

PayEdge offers industry-specific solutions for various sectors, including FMCG, Telecoms, Oil & Gas, Financial Services, Utilities, and the Public Sector.

PayEdge offers solutions like dynamic discounting, reverse factoring, and flexible financing options, allowing you to free up working capital trapped in receivables.

Faster payments and early settlement discounts foster trust and collaboration with your suppliers, strengthening your partnerships.

By receiving payments faster and lowering financing costs, PayEdge helps you improve your financial health and manage your receivables effectively.

Transparent and timely payments through PayEdge? demonstrate your reliability and foster long-term partnerships with buyers.

PayEdge connects you with pre-vetted businesses offering competitive returns, allowing you to earn attractive profits on your investments.

PayEdge offers financing options across various industries, enabling you to spread your investments and mitigate risk.

PayEdge utilizes AI-powered fraud detection and data-driven analysis to mitigate risk and ensure the security of your transactions.

Yes, PayEdge is designed with a user-friendly interface, making it easy to use and navigate even for those unfamiliar with complex financial systems.

Yes, PayEdge offers seamless integration with various existing systems, ensuring a smooth transition and minimal disruption to your existing workflow.

You can schedule a free demo to learn more about the platform and discuss how it can benefit your business. Simply visit our website or contact our sales team for further assistance.